Introduction

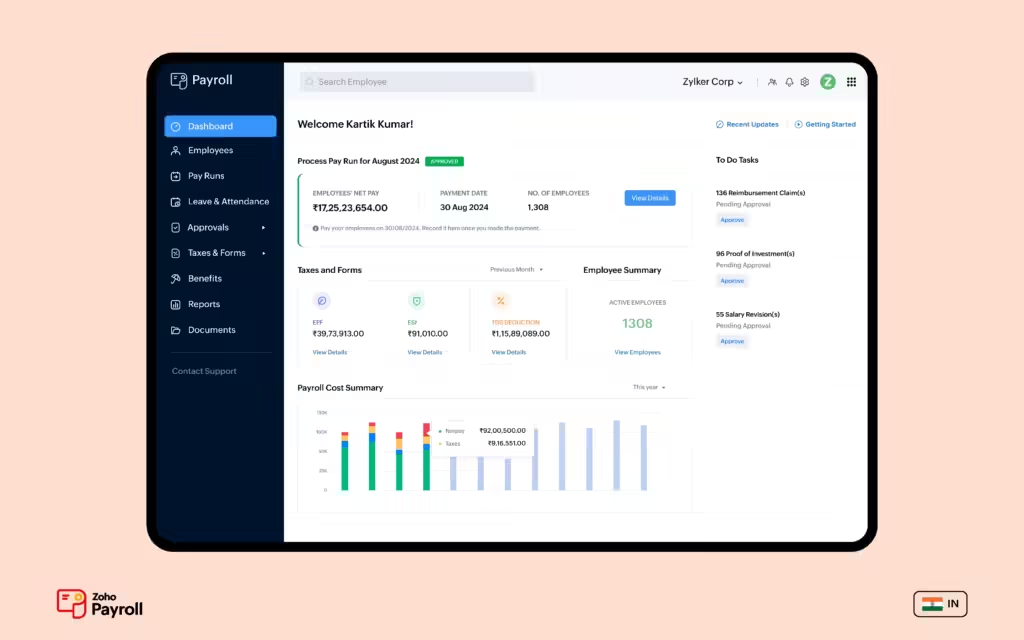

ZOHO Payroll

Efficient payroll management is essential for businesses to ensure timely, accurate employee payments and maintain tax compliance. ZOHO Payroll provides a cloud-based solution that automates and simplifies this critical process. For small and medium-sized businesses, ZOHO Payroll offers significant benefits, streamlining payroll operations, improving accuracy, and ensuring compliance with all legal requirements.

This guide provides a comprehensive overview of ZOHO Payroll, covering its features, benefits, pricing, integrations, and setup, to help you decide if it’s the ideal payroll system for your business.

What is ZOHO Payroll?

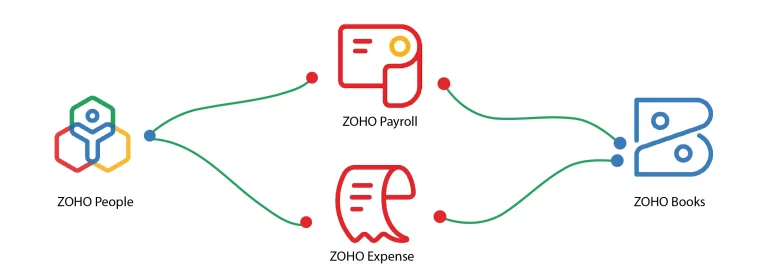

Designed for efficiency, ZOHO Payroll is a cloud-based solution that automates payroll, manages payments, and ensures tax compliance, while its seamless integration with ZOHO Books and ZOHO People creates a powerful operational suite.

Key Features of ZOHO Payroll

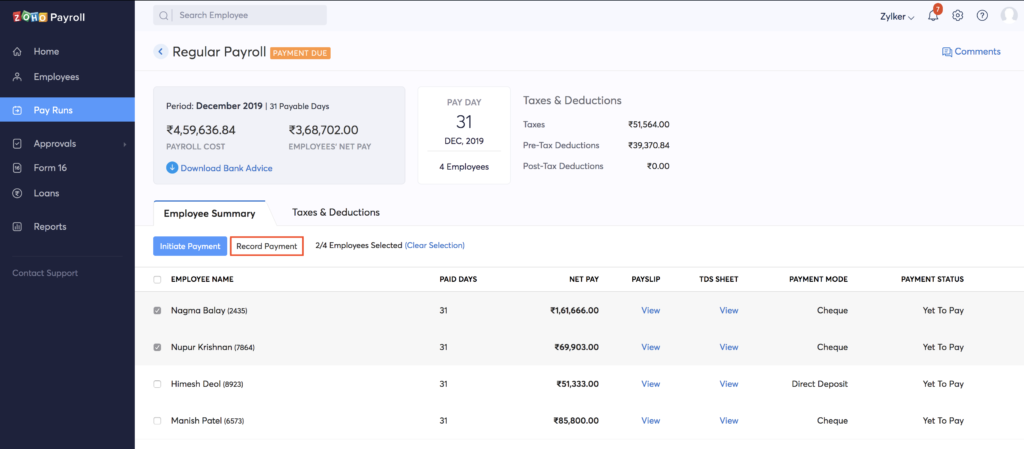

1. Automated Payroll Processing

This system automatically calculates employee salaries, including all applicable taxes and deductions. It generates and distributes electronic or printed payslips to employees. It supports various payment methods, such as direct deposit, for convenient salary disbursement.

2. Tax Compliance & Statutory Deductions

Minimize your risk with our system designed for full compliance with federal, state, and local tax regulations. Simplify TDS management by automating calculations and filings, saving you time and resources. Gain peace of mind with readily available compliance reports, ensuring you’re always prepared for audits.

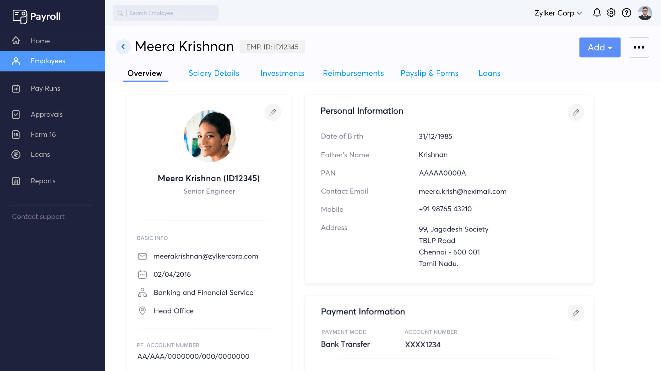

3. Employee Self-Service Portal

Employees have access to digital payslips, detailed tax deduction information, and comprehensive salary breakdowns. The system allows employees to easily submit reimbursement requests and investment declarations. This streamlined process promotes greater openness and significantly lessens the load of administrative tasks.

4. Direct Deposits & Payment Flexibility

Offers versatile payment methods, including direct deposit and physical checks. Integrates with diverse banking platforms to facilitate smooth and efficient transactions. Minimizes payroll discrepancies and guarantees on-time payments.

5. Comprehensive Reports & Insights

Analyze payroll data instantly with real-time analytics and comprehensive financial reporting. Generate custom payroll reports to improve decision-making and strategic planning. Monitor salary trends, tax payments, and compliance status to ensure accuracy and avoid penalties.

6. Multi-Location & Multi-Currency Support

Ideal for businesses with operations spanning multiple locations or countries. It accommodates diverse tax systems and salary structures .

Benefits of Using ZOHO Payroll

Time Efficiency & Accuracy

By automating payroll and tax filings, it minimizes human error and lightens the administrative workload. Automating payroll calculations and tax filings saves time and reduces the risk of errors. This automation of payroll and tax filing cuts down on errors and simplifies administrative tasks.

Regulatory Compliance

Assists businesses in adhering to all applicable government tax regulations and required statutory deductions. Provides support to businesses to maintain compliance with federal, state, and local tax laws, as well as mandated deductions.

Employee Satisfaction

Employees can easily access payroll information through the self-service portal, enhancing their overall experience. The self-service portal offers employees convenient access to payroll information, leading to a better experience.

Seamless Integrations

Achieve greater payroll efficiency through seamless integration with ZOHO and compatible accounting software. By working with ZOHO and other accounting programs, this feature helps you optimize your payroll processes.

ZOHO Payroll Pricing Plans

ZOHO Payroll offers flexible pricing based on the number of employees and required features. The typical pricing structure includes:

- The Basic Plan is perfectly suited for the needs of startups and small businesses. Our Basic Plan offers the right features and price point for startups and small businesses. For startups and small businesses, we recommend our Basic Plan.

- The Standard Plan lets you manage multiple locations and gain deeper insights with advanced reporting. Enhance your business operations with the Standard Plan, featuring multi-location support and advanced reporting.

- The Enterprise Plan delivers bespoke payroll solutions to meet the complex needs of large-scale businesses. Large businesses can streamline their payroll processes with the Enterprise Plan’s customized features.

Businesses can test-drive ZOHO’s software with a free trial to ensure it meets their needs. ZOHO’s free trial lets businesses experience the software’s capabilities before they commit to a purchase.

Take advantage of ZOHO’s free trial to fully explore its software features before making a purchase. Once you’re ready to implement payroll, learn how to set up ZOHO Payroll for your business.

Step 1: Sign Up and Configure

- Create an account and enter company details.

- Configure tax settings and statutory compliance.

Step 2: Add Employees

- Enter employee details, salary structure, and tax information.

- Assign payment methods and deductions.

Step 3: Process Payroll

- Run a test payroll to ensure accuracy.

- Automate salary calculations and generate payslips.

Step 4: Ensure Compliance

- Verify tax deductions and statutory contributions.

- Generate reports for compliance tracking.

ZOHO Payroll Integrations

ZOHO Books

ZOHO Books lets you synchronize your payroll data with your accounting records. Seamlessly sync payroll data with your accounting using Zoho Books. Zoho Books integrates payroll data with your accounting system.

ZOHO PEOPLE

Zoho People helps you manage employee records and track attendance. Zoho People provides tools for managing employee records and attendance tracking.

Third-party banking systems

Third-party banking systems enable seamless direct deposits. Seamless direct deposits are enabled by third-party banking systems

Conclusion

ZOHO Payroll offers a powerful yet affordable payroll management solution for small to medium businesses, packed with features and easy to use. Experience the benefits of automated processing, worry-free tax compliance, and smooth integrations, all designed to improve accuracy and efficiency. Looking for a reliable payroll system that scales with your growing business? ZOHO Payroll is an excellent choice. Take advantage of the free trial and discover its capabilities!

FAQs

ZOHO Payroll

1. Is ZOHO Payroll free?

ZOHO Payroll offers a free trial, but the full version requires a paid subscription.

2. Can ZOHO Payroll handle multi-state payroll?

Yes, ZOHO Payroll supports multi-state compliance and statutory regulations.

3. Does ZOHO Payroll integrate with QuickBooks?

While ZOHO Payroll primarily integrates with ZOHO Books, third-party integrations can be set up.

4. How secure is ZOHO Payroll?

ZOHO Payroll follows industry-standard encryption and role-based access controls for security.

5. Can employees access their payslips online?

Yes, ZOHO Payroll provides a self-service portal for employees to access their payroll details.

Ready to Take Your Business to the Next Level?

If you need help setting up custom apps with ZOHO or want expert guidance, get in touch with us today! For more info read this .

📞 Phone: +91 7838402682

📧 Email: team@codroiditlabs.com

🌐 Website: www.codroiditlabs.com