Online payroll software has become an essential tool for modern businesses looking to simplify their financial and HR operations. By transitioning from outdated manual practices, companies can build a better workplace that is scalable and fully compliant with national regulations. This guide explores how a robust online payroll software solution like Zoho Payroll provides a unified platform for everything from onboarding to final settlements.

1. Streamlining Employee Management with Online Payroll Software

The journey of an employee begins with a smooth onboarding process, and online payroll software ensures that new hires settle in quickly with structured operations. By centralising all employee information in one unified location, businesses can significantly reduce data entry errors and save countless administrative hours.

For growing teams, the ability to filter data using custom views allows managers to quickly group and review employee details without navigating through multiple complex screens. Additionally, online payroll software makes rehiring easier by automatically retrieving details from the previous financial year for exited employees. Beyond regular staff, the system allows for the easy onboarding and organisation of contractors, keeping their reporting details and documents structured throughout their tenure.

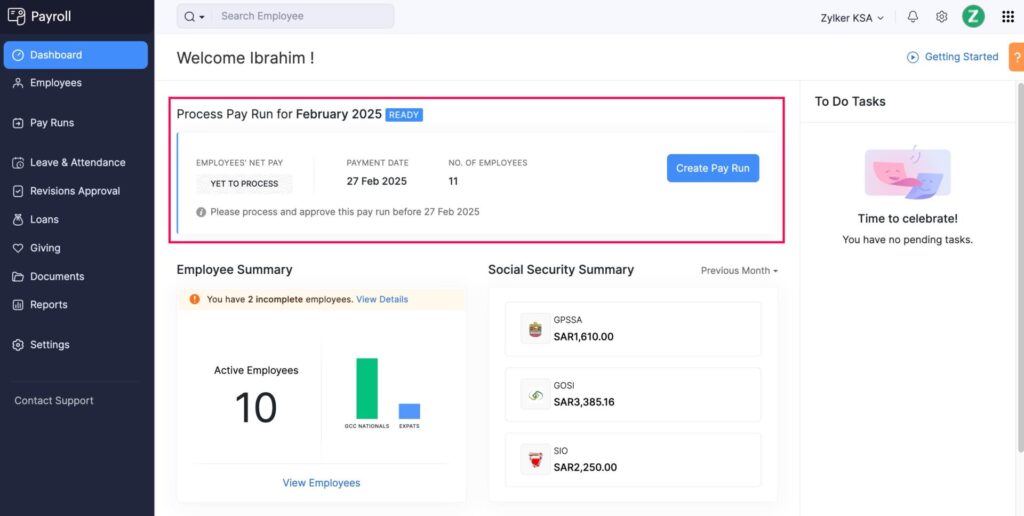

2. Effortless Payroll Processing and Administration

The primary goal of online payroll software is to turn payroll into a routine that is fast, accurate, and effortless. Businesses can process payroll in minutes rather than days by using automated and compliant processes. This includes the ability to:

- Define Flexible Schedules: Create payroll timelines that account for weekends, holidays, and specific workdays.

- Customise Salary Components: Easily add allowances, earnings, or deductions to any pay run.

- Handle Off-Cycle Payments: Manage salary revisions, bonuses, or incentives outside of regular cycles.

- Manage Multi-location Teams: Process accurate payroll for employees working across different offices or remotely while assigning the correct work location for each individual.

3. Built-In Statutory Compliance for India

One of the most critical features of online payroll software is its ability to handle regionally intricate compliance regulations across all 28 Indian states. The system stays tax-ready automatically with built-in calculations for:

- EPF (Employee Provident Fund): Configure contributions to match company policies while remaining regulation-compliant.

- ESI (Employee State Insurance): Automated deductions provide financial security for employees during health emergencies.

- PT, LWF, and Statutory Bonuses: Automated checks help businesses avoid penalties and maintain social security standards.

Furthermore, online payroll software allows users to download essential tax forms like 12BB, 24Q, TDS, and Form 16 with built-in e-signature capabilities.

4. Flexible Salary Configurations and Benefits

To reward employees effectively, online payroll software provides tools for diverse salary structures. Admins can use pre-built templates or create tailored components like performance bonuses and travel claims. The system also supports flexible CTC planning, allowing employees to distribute their CTC across components like HRA, LTA, and fuel allowances within preset organisational limits.

Managing employee benefits becomes effortless with automated vehicle perquisite handling and the tracking of both pre-tax and post-tax deductions. This ensures that employees can maximise their tax savings while the business maintains control over its expenses.

5. Empowering Teams with an Employee Self-Service Portal

A modern online payroll software experience includes a dedicated portal where employees can manage their own data. Through this portal, staff can:

- Download payslips and TDS worksheets effortlessly.

- Submit IT declarations and Proof of Investment (POI) digitally.

- Track attendance, apply for leave, and view loan repayment statuses.

- File reimbursement claims and attach receipts for verification.

This transparency reduces back-and-forth email threads and allows HR teams to address employee questions faster.

6. Deep Integrations with Business Systems

The power of online payroll software is amplified when it is natively connected to other core business functions. Integrating with an HRMS like Zoho People allows for real-time syncing of attendance and LOP data. Similarly, connecting with accounting software ensures that payroll transactions are recorded automatically, keeping the company’s books accurate and tax-ready.

For businesses that require secure and timely payments, online payroll software integrates directly with major banks like ICICI, YES Bank, and HSBC. This enables direct deposits and automated bank advice generation, ensuring staff are paid on time, every time.

7. Data Privacy and Scalable Pricing

Security is paramount when handling sensitive financial data. Leading online payroll software secures data with 256-bit SSL encryption, two-factor authentication, and regular virus detection. Role-based access control ensures that team members only see the data relevant to their specific duties.

Businesses of all sizes can benefit from these tools, with pricing plans designed to scale. Startups with up to 10 employees can even access a “Free Forever” plan that includes automatic payroll calculation and payslip generation. As the business grows, they can upgrade to Standard, Professional, or Premium plans to access advanced features like custom schedulers and workflow rules.

Conclusion

Adopting an online payroll software solution is a game-changer for businesses seeking to streamline administration and ensure 100% compliance. By automating complex calculations and providing a transparent portal for employees, companies can save hundreds of hours every year.

Ready to Get Started on Zoho?

Let’s build your business the smart way — with Zoho and Codroid Labs by your side.

📅 Book your free consultation now