In today’s post‑COVID world, digital payments have moved from being a nice‑to‑have option to an essential part of running a business. For small and medium‑sized businesses (SMBs), staying competitive is no longer just about accepting UPI or QR code payments. It’s about choosing the right system — and that’s where the comparison of Bharat Pay vs Zoho POS Machines becomes crucial. These complete Point of Sale (POS) systems go beyond payments, handling everything from billing and inventory to reporting and financial tracking.

The Changing Role of POS Machines

Modern POS systems have evolved far beyond simple card‑swiping devices. They now act as the digital backbone of a merchant’s operations — managing payments, stock, and analytics in one place. With many companies entering India’s fast‑growing fintech space, business owners need to carefully compare options Bharat Pay vs Zoho POS Machines.

1. BharatPe POS: A Closer Look

BharatPe offers two main POS devices:

- BharatPe Swipe: Supports payments via card and UPI, including debit, credit, and QR methods.

- BharatPe One: Combines POS functions, a QR scanner, speaker, and tap‑and‑pay (NFC) features in one compact machine.

These devices connect through Wi‑Fi, 3G/4G (SIM), or Bluetooth and often include extras like receipt printing and barcode scanning.

Pricing Model

BharatPe is popular among small merchants due to its low Merchant Discount Rate (MDR) and frequent offers such as free trials or onboarding bonuses. The cost usually includes either purchasing or leasing the device, plus a small transaction fee and optional service charges. BharatPe often subsidizes fees for small retailers to support adoption.

Integration & Ecosystem

The BharatPe ecosystem centers around merchant services such as digital lending, loyalty programs, QR payments, and analytics. Transactions are settled quickly, often instantly, to the merchant’s bank account. However, integration with third‑party accounting or ERP software is limited.

Best For

BharatPe POS suits small stores, local shops, eateries, and salons that prefer simplicity and lower costs over advanced integration.

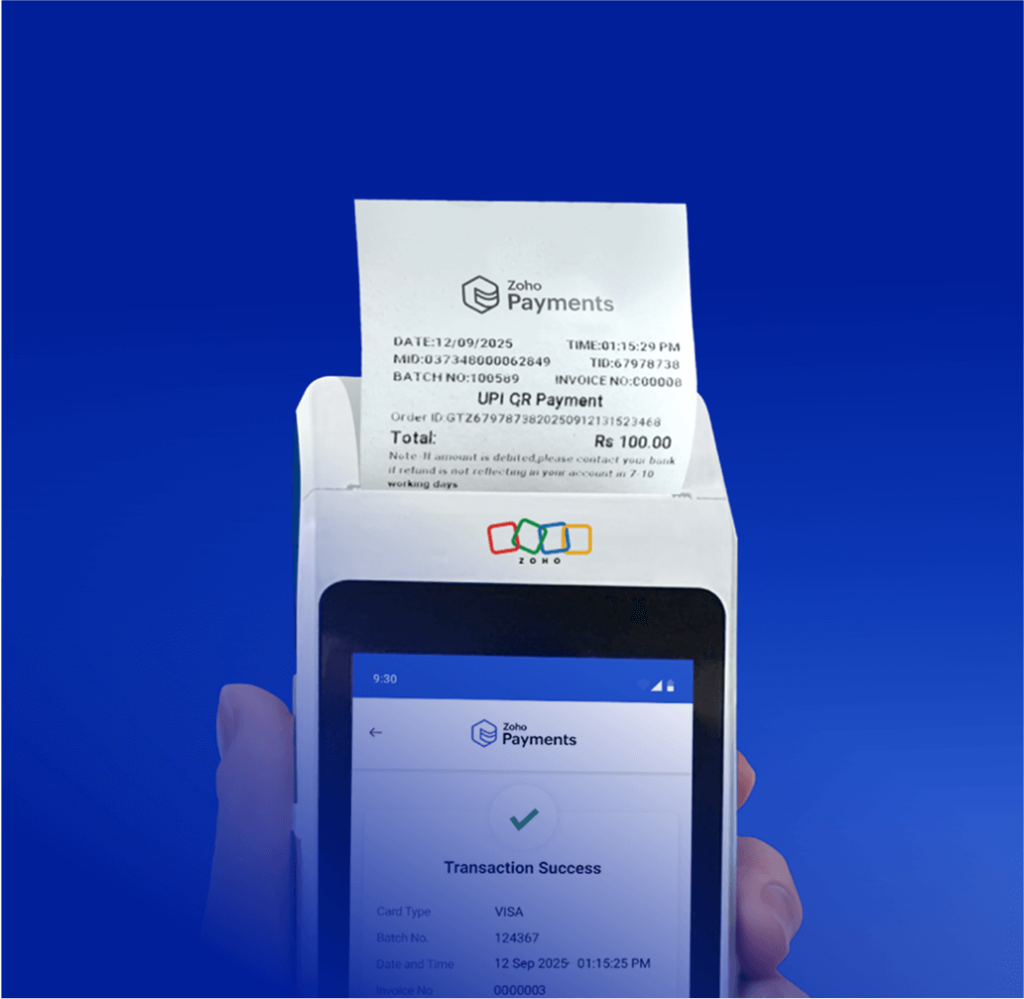

2. Zoho POS / Zakya / Zoho Payments:

Ecosystem Strength

Zoho POS stands out for its tight integration with the Zoho business suite, including Zoho Books, Inventory, CRM, Billing, and Commerce. This provides a unified platform for managing sales, inventory, customer data, and finances — all in one place. Zoho also holds licenses to operate as a payment aggregator, which ensures smooth and compliant transactions.

Technical Capabilities

Zoho POS is a cloud‑based solution, meaning it requires minimal hardware and allows remote access to data. It supports real‑time analytics, mobile billing, offline operation, and payment methods like QR, cards, and UPI. It also includes advanced tools for barcode tracking and pricing management.

Pricing

The pricing structure varies by transaction type and volume, often combining a small per‑transaction fee with optional hardware or subscription bundles. Existing Zoho users may receive discounted or integrated packages. All payments are automatically linked to other Zoho apps without the need for third‑party gateways.

Integration & Flexibility

Zoho POS connects directly with Zoho’s ecosystem, allowing smooth data flow between sales, accounting, and inventory modules. It also provides APIs for custom integrations and workflows, making it suitable for businesses with multiple outlets or complex operations.

3. Comparison at a Glance

| Metric / Factor | BharatPe POS | Zoho POS / Zakya |

|---|---|---|

| Transaction Speed | 1–3 seconds | 1–4 seconds |

| Security & Compliance | Encrypted, PCI compliant | PCI compliant, software‑level security |

| Ease of Use | Simple, beginner‑friendly | Advanced, suited for growing businesses |

| Support & Service | Strong on‑ground support | Digital‑first support with expanding hardware coverage |

| Multi‑Outlet Scalability | Moderate | Excellent for multi‑store operations |

| Integration Capability | Payment‑focused | Full suite integration (CRM, billing, inventory) |

| Settlement Speed | Fast, often instant | Fast, varies by method |

| Customization | Limited | Highly customizable via APIs |

4. Pros and Cons

BharatPe POS

Pros:

- Low fees and quick setup

- Instant settlements

- Great for small vendors and startups

- User‑friendly interface

Cons:

- Limited integration with other business systems

- Not built for advanced inventory or multi‑store management

Zoho POS

Pros:

- Complete integration with Zoho apps

- Ideal for expanding businesses

- Strong cloud and data capabilities

- Highly flexible and customizable

Cons:

- Slightly higher learning curve

- Hardware support still developing

- Higher initial cost for small merchants

5. Conclusion

The right POS system is more than just a payment device — it’s the central hub of your business operations. For small traders who prioritize affordability and simplicity, BharatPe POS is a practical choice. However, for businesses aiming to scale and manage everything — sales, accounting, customer relationships, and inventory — from one platform, Zoho POS offers far greater long‑term value.

Your decision depends on where your business stands today and where you plan to go next. A well‑chosen POS system can streamline daily operations, boost efficiency, and create a better experience for customers.

Ready to Get Started on Zoho?

Let’s build your business the smart way — with Zoho and Codroid Labs by your side.

📅 Book your free consultation now

Frequently Asked Questions (FAQs)

1. What is the difference between Bharat Pay POS and Zoho POS?

Bharat Pay (via BharatPe) focuses strongly on payment acceptance, low MDR, and merchant services. Zoho POS (Zakya / Zoho Payments) offers deeper integration with accounting, inventory, CRM, and business workflows.

2. Can Zoho POS integrate with my existing Zoho Books / Inventory / CRM?

Yes, one of the big advantages of Zoho POS is its native integration across Zoho’s suite — sales from the POS flow automatically into accounting, inventory adjusts, customer records sync, and reports become unified.

3. What kinds of payments do both POS machines accept?

Both Bharat Pay and Zoho POS generally support card payments (debit/credit), UPI / QR payments, and contactless payments, depending on the hardware model.

4. What are the transaction or MDR charges for Bharat Pay vs Zoho POS?

Charges depend on the contract / merchant agreement. Bharat Pay often offers very competitive or subsidized MDRs, especially for UPI or small-ticket transactions. Zoho’s fees will depend on volume, payment type (card vs UPI), and the pricing tier you negotiate.

5. How fast is settlement to my bank account?

Settlement speed can vary. Bharat Pay is known for relatively fast or instant settlement on card collections (depending on terms). Zoho POS/Payments also aims for speedy settlements, though exact timing depends on banking / gateway settlement cycles.